What is a DAF?

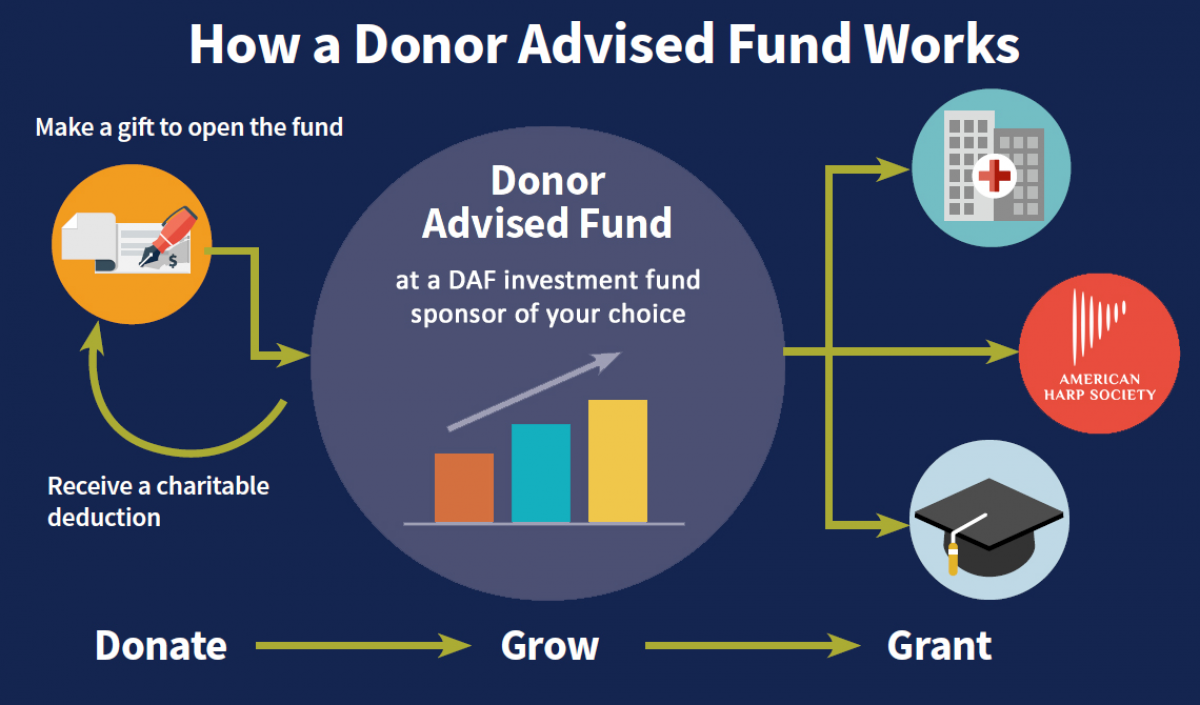

A donor advised fund (DAF) is a specialized financial account used for charitable giving. It allows individuals to make a charitable contribution, receive an immediate tax deduction and then make grants to 501(c)(3) organizations over time.

The money in a DAF can also grow tax free and be donated at any time in the future - there are no time limits or distribution requirements for DAFs today.

What are the benefits of a DAF?

Anyone can set up a DAF - either through companies that provide banking services (Fidelity, Vanguard, Schwab, etc.), newer startups dedicated to DAFs (Daffy, Charityvest, Groundswell, etc.) or often through local community foundations.

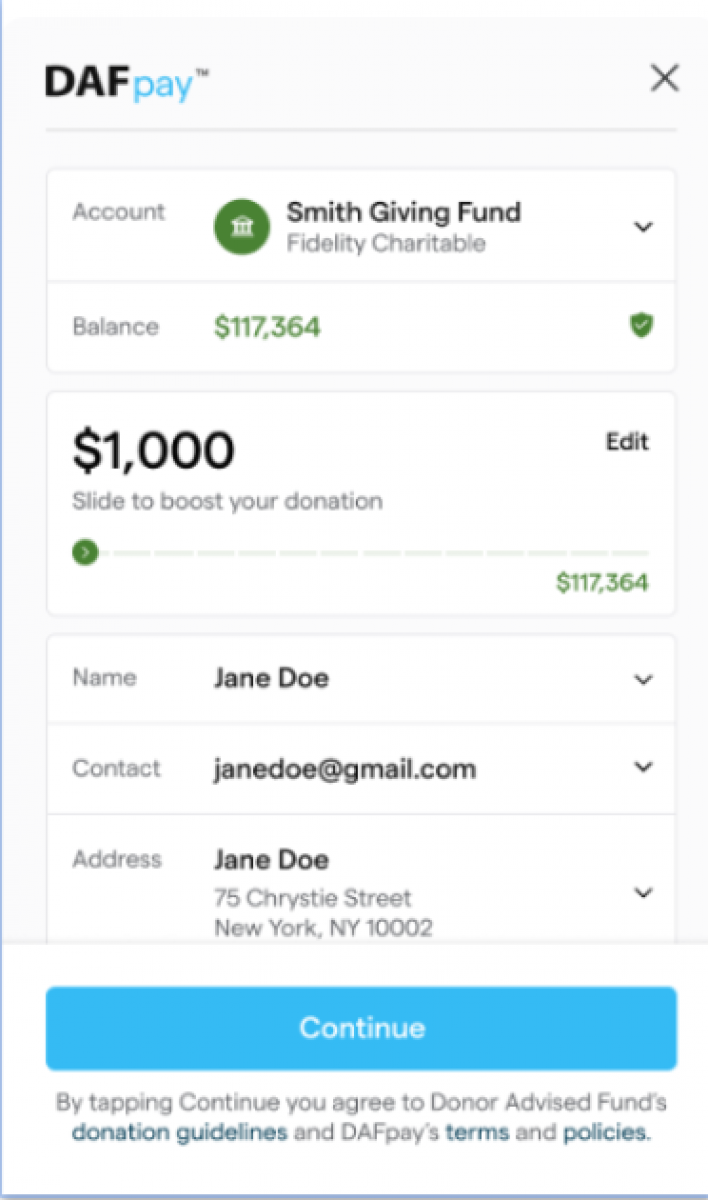

We’re delighted to announce that DAYpay from Chariot is now integrated with all of the donation forms used by AHS. It functions similarly to payment options like Apple Pay or Google Pay, where you’ll see the DAFpay option during the checkout process on any donation form.

DAFpay integrates with various DAF providers (over 300!), allowing you to log into your DAF accounts and direct funds to charities seamlessly. Here's an example:

With DAFpay,